Fiduciary vs. Suitability

Deciphering the “What’s What” and “Who’s Who” of today’s complex financial services industry

Do you receive Financial Advice to the Fiduciary Standard of Care or the Suitability standard? It’s important to know!

Deciphering the “What’s What” and “Who’s Who” of today’s complex financial services industry can be difficult, even for the most financially sophisticated members of the general investing public. Two words: fiduciary and suitability, are critical in understanding the motivation behind the person offering you financial products or advice.

Recognizing the difference between the fiduciary and suitability standards may also help you to appreciate the level of care you receive from a trusted financial advisor. Although the distinction between the fiduciary and suitability methods of offering advice is rarely discussed by “broker-led” large financial companies, we feel it is essential for investors to know the difference.

BROKER

(the suitability standard):

- Offers products for sale from a range of products carried by the company he or she represents

- Is paid commissions calculated as a percentage of the amount of money invested into the product

ADVISOR

(the fiduciary standard):

- Offers “best advice” taking into account the needs of each individual client

- Is paid a quarterly fee calculated as a percentage of the assets under advisement

“What’s What” relates to the standard of care upon which financial advice is provided to the investing public:

The fiduciary standard requires advice to be provided in the best interests of the client including the disclosure of possible conflicts of interest.

The suitability standard states that a broker only needs to check the suitability of a prospective buyer, based primarily upon financial objectives, current income level and age, in order to complete a commissionable sale of a financial product. In a way, when a broker checks the suitability of a potential buyer, they are measuring how much financial product can be sold, not the needs of the investor. No disclosure of possible conflicts of interest is required. Common differences between the two standards involve trading commissions; for example commissions and incentives paid by mutual fund companies back to the broker dealer. These inter-company inducements can create conflicts between the investor’s requirements and the motives of the broker. When a company suggests the purchase of a proprietary product, such as a mutual fund or an inventoried security, such as a bond, in the knowledge they will receive a direct and upfront commission, can that suggestion be relied upon to be fair for the advantage of the client?

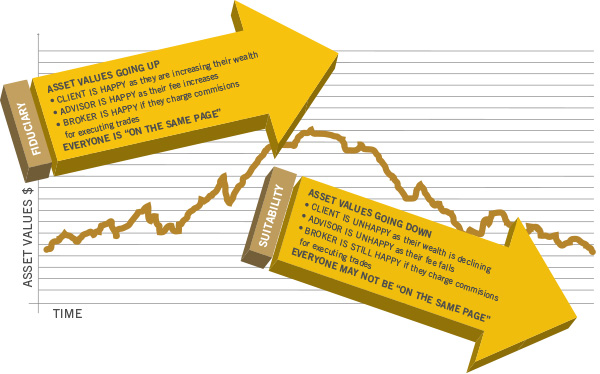

*The hypothetical chart shown above could be representative of any security or portfolio including Bonds, Stocks and other investments. It is intended as an illustration of a general concept and should not be considered a representation of actual performance, past or future.

WHY SHOULD YOU CARE?

The differences discussed above were a contributor to the 2008 credit crisis, especially within the selling of complex financial products based on housing debt. More recently, the initial public offering (IPO) of Facebook stock was roiled by alleged conflicts of interest by those offering the stock.

Every day, financial products are sold for a commission and include internal costs and fees which are difficult to find and define. The dollar value of these commissions and additional internal costs are usually deducted from the amount an investor invests in a financial product. The total return of such a product may therefore be reduced by the value of these hidden costs. In 2010, the Wall Street Journal brought this issue to the attention of the investment public with their article: “The Hidden Costs of Mutual Funds.”1 A further example of how low the bar is set for broker disclosure of costs and conflicts can be found within the article “Shining a Light on Murky 401(k) Fees.”2

1 The Hidden Costs of Mutual Funds published March 1st, 2010. Copyright Wall Street Journal.

2 Shining a Light on Murky 401(k) Fees published November 13, 2010. Copyright Wall Street Journal.

The diagram on the next page provides a general example of how the two different standards— fiduciary & suitability—may affect your relationship with the people and corporations you rely on for financial advice. Are you and your financial advisor both “on the same page?”

Since 2008, the U.S. Government has also begun to care about how financial recommendations are delivered to members of the general investing public. The lack of “self-policing,” protection of client interests and frequent scandals have led our legislative system to pass The Dodd-Frank Wall Street Reform and Consumer Protection Act.

One goal of this legislation was the creation of a single standard for financial advice based upon the current fiduciary standard.

Informed investors should ask: “Why does the government feel I need protecting and from what?”

Today’s financial industry offers its clients a wide range of options. In our eyes, every client deserves to have their needs put first and solutions offered according to those needs.

A Global Financial Advisor can help you to understand these options and work with you to decide how they might impact your specific financial needs.

Prior to meeting with a Global Financial Advisor, ask your current or prospective financial advisor if they are acting as a broker or an advisor.

Ask them to formally list all the areas in which they and their company can receive commissions. If they cannot or will not, we strongly urge you to consider whose best interests they have at heart.